In 2015, I already wrote an article about my forecasts for the future of the real estate market. This year I decided to continue the tradition and write a real estate market forecast for 2017 and 2018. Since I am a realtor in Moscow, I make a forecast of the real estate market in Moscow.

I would like to start my analysis with the fact that there has always been demand for real estate! Real estate is a necessary commodity. Only the solvency of buyers could decrease, and not their number. Also, I do not believe that what is happening in the market now can be called a crisis. The crisis happened in 2008. And what has been happening in the Russian economy since 2015 can be described in one word: access to easy money is closed! And for everyone, from the ordinary citizen to the state. So we're just living in a real economy period. And all talk about the crisis must be attributed to the geopolitical redivision of the world. And since I touched on politics, I cannot mention the fact of the future presidential elections in the Russian Federation. I assume there will be a slight saturation of the market with money, which will slightly affect the solvency of buyers.

In 2016, the number of offers on the residential real estate market reached a historical maximum. And apparently, in the coming year, the volume of new housing commissioning is not going to increase. I suppose we will still see major bankruptcies of some developers. If we recall the situation on the market for new buildings ten years ago, all apartments were sold out at the initial stage of construction. Now the situation has changed dramatically. There are built houses in which more than half of the apartments have not been sold. Moreover, a large number of such apartments are already finished or with high-quality repairs. And this entire volume of unsold new buildings is in direct competition with apartments on the secondary real estate market. Because the price in new buildings is lower (or the same), the quality is in most cases higher and after purchase you can immediately move and live.

What do we actually have?

1. Consumer demand has not decreased, but only reduced its solvency.

2. The number of offers on the market exceeds demand and continues to grow.

3. The crisis has been sluggish for several years and continues to maintain its stability.

Based on this, my real estate market forecast next - the market will continue its trend towards a slow but sure decline in prices. This will continue smoothly over the next two years. I do not expect sharp price drops, nor any increase. Market dynamics indicate that the annual projected decrease in the value of real estate will occur within 5-10%.

What to do in this situation?

The first and most basic advice is to be realistic and study real estate market forecasts. You must understand that there will no longer be a buyer on the market ready to buy your apartment without looking or haggling. Before making a purchasing decision, the buyer will study all the numerous offers and choose the best and cheapest from them. Therefore, if you want to sell an apartment, look at the market dynamics six months in advance. Simply put, if you want to sell an apartment now, set the price for it that will be for it in six months. Or you will find yourself in one of the train cars standing on a siding. Also, it is worth taking into account the changing mentality of the Moscow buyer. Today, the buyer, in most cases, will give priority to new modern housing in the nearest Moscow region, rather than buying an apartment for the same money in old five- or nine-story buildings in Moscow.

A ?

You should no longer count on a sharp decline in real estate prices. Yes, as I already wrote, prices will slowly decline in any case. But what does the buyer need? Solve your housing problem, but a wait-and-see attitude, taking into account annual monetary inflation, will not solve anyone’s problems. The best buyer position in the real estate market, buy now the best property at the best price.

Well, what should those who want to invest money in residential real estate for investment purposes (rent out or sell at a profit in a few years) do? I want to disappoint you right away, this event is doomed to failure from the very beginning. The maximum you can get now by renting out an apartment is 4 or 5% per annum. Don't forget to subtract property taxes, income taxes, depreciation expenses, and things get even sadder. And I don’t see any point in talking about hopes that will be more expensive in a few years.

This is how it seems to me, based on my knowledge and professional experience. Could I be wrong? Certainly can! Unfortunately, in our country, any analysis can be crossed out with the stroke of the pen of one of the powers that be. But here I am powerless.

How many housing transactions are taking place in Moscow, the volume of supply of new buildings, mortgage rates and other results of the outgoing year

In 2017, the Moscow housing market set a number of records in terms of the number of transactions and the volume of supply of new buildings; mortgage rates also reached a historical minimum. Perhaps the main topic of the past year was the large-scale program of demolition of Khrushchev-era buildings.

The final material contains the main figures of the outgoing year: from atypically large discounts to a record number of transactions with new buildings.

47 518 apartments purchased in new buildings

Over the 11 months of 2017, in Moscow there were 47,518 equity participation agreements (EPA - transactions in new buildings), which is already 54% more than for the entire 2016, and twice as much as in the pre-crisis 2014. In November, Rosreestr recorded the largest number of sold apartments in the entire history of the capital’s new buildings market - 5,597.

More 1 million mortgage loans

At the end of 2017, there was a record number of mortgage loans in Russia - more than 1 million in the amount of 1.9-2 trillion rubles. In 2014, the historical record for mortgage issuance volumes was RUB 1.7 trillion. Also, mortgage rates reached a historical low and at the end of the year stood at 9.8% for new buildings and 10.02% on the secondary market. In Moscow in November, the number of home purchases using a mortgage loan was 6,012 - the highest in the entire history of observation. Since the beginning of 2017, Rosreestr has registered 47,441 transactions involving mortgages, which is 23% more than for the entire last year.

2.85 million sq. m of new buildings

In Old Moscow, 2.85 million square meters are sold on the primary market. m of housing. The total volume of supply of new buildings within the old borders of the capital is the first time in the history of the real estate market that their volume is in the Moscow region (in the area up to 30 km from the Moscow Ring Road), where 2.77 million square meters are sold. m. A little more than two years ago (based on the results of the first half of 2015), in the Moscow region, according to realtors, supply was more than twice as high as the capital’s volumes: 3.82 million sq. m. m versus 1.26 million sq. m respectively.

20 year old The share of apartments on free sale has reached its maximum

In Moscow, for the first time in the history of the residential real estate market, the share of apartments in the free sale of alternative properties is 51.1% versus 48.9%, respectively. For comparison: three years ago the ratio was 27.3% and 72.7%, respectively. The increase in quality supply in new buildings over the past three years has provoked an outflow of buyers from the secondary market to the primary one. In addition, secondary owners who plan to improve their living conditions by purchasing an apartment in a new building sell their existing living space and do not need an alternative on the secondary market.

88% apartments sold at a discount

The maximum share of transactions with a discount on the secondary market of Moscow in the outgoing year was in June and July (88%). The average discount on these deals was about 8-10%. First of all, its size depends on what the initial price of the object being sold was, and sometimes reaches 20-30%. On the primary market in most new buildings throughout the year, buyers were also provided with various promotions, which reached their peak by the New Year. In the vast majority of projects, New Year's discounts do not exceed 10%, and the maximum reaches 33%. New Year discounts of less than 10% are quite rare.

₽178 thousand for 1 sq. m cost of secondary housing

The average ruble price at which owners put apartments up for sale on the secondary market in Moscow, at the end of 2017, was the lowest since November 2013: 178.2 thousand rubles. for 1 sq. m. The sales price, which appears in real transactions, has decreased by 8% since January and has completely returned to the 2011 level.

5171 The house will be demolished as part of renovation

On July 1, President Vladimir Putin passed a law on the mass demolition of multi-storey buildings in Moscow. According to the document, buildings no higher than nine floors built from 1957 to 1968 are eligible for renovation. The final list included 5,171 houses where over 1 million Muscovites live. The first relocations under the renovation program will begin in February 2018. According to the capital authorities, in Moscow today there are 236 sites at the design and construction stage with a construction volume of about 3.5 million square meters. m. Renovation of all five-story buildings will last 15 years and the capital’s budget will amount to 3-3.5 trillion rubles.

$3 billion invested in commercial real estate

The volume of investment transactions with offices, shopping centers and warehouses in the Moscow region has doubled over the past year - from $1.5 billion to $3 billion. By the end of the year, this volume may increase slightly due to transactions that have not yet been closed. About half of all transactions were concluded with the participation of foreign investors. Most often, investors invested money in the purchase of retail properties in Moscow - the share of the capital region in the total investment volume is now 84%. In total, 1.3 million square meters were commissioned in Moscow this year. m of commercial real estate versus 4 million sq. m - peak indicators in 2014. At the same time, for the first time in 2017, fewer offices, shopping centers and warehouses were commissioned in Moscow than in other Russian cities.

₽120 thousand for 1 sq. m will cost housing by 2020

Housing prices in Moscow will continue to fall until 2024. By 2020, the cost of apartments in the capital will decrease by 20-30% from the current level, after which the market will reach the bottom. The annual decline will thus be about 10%. This is the forecast of the head of the analytical center “Real Estate Market Indicators IRN.RU” Oleg Repchenko. Prices should stabilize at 120 thousand rubles. for 1 sq. m. According to his forecast, a new increase in value may begin closer to 2024 or after it.

The crisis has left a noticeable mark on each sector of the Russian economy. In particular, it affected the housing sector. People are already looking for reliable forecasts for real estate prices in 2017. You can hear from industry analysts about impending instability and declining demand. All this is a consequence of sanctions, falling prices per barrel of oil, rising foreign exchange rates, bank lending rates, and poor solvency of citizens. These factors have a significant impact on developers.

In the capital of the Russian Federation, the reaction to the crisis situation is manifested to a lesser extent. There are many non-poor people living there who still have the opportunity to invest in real estate. Sponsors do not stop working on large-scale buildings in various parts of Moscow. However, experts remind that compared to the stable years before the crisis, this is just a drop in the ocean and remnants of its former greatness. In the near future, the real estate crisis will engulf the entire state.

The experts failed to agree. Some argue that real estate prices will fall, while others believe that the increase in the cost of building materials will lead to an increase in the price per square meter, because development companies also need to cover their needs. In addition to purchasing raw materials, they need to pay salaries to employees, provide insurance and spend on logistics. It is necessary to understand in more detail the points of view that currently exist.

Real estate forecast for 2017-2018

The Ural Real Estate Chamber claims that serious upheavals will occur over the next two years. T. Demenyuk (Russian Realtors Guild) gave a forecast for real estate in 2017:

- she noticed that the housing market is already becoming less profitable. A few years ago, the industry situation was much more encouraging;

- according to survey results, 1 out of 10 residents of the Russian Federation who planned to buy an apartment abandoned their plan, while 1 out of 6 postponed it indefinitely;

- Already at the beginning of 2016, there was a market recession, giving every reason to believe that an inevitable crisis awaits citizens in the future;

- stabilization will occur no earlier than 2020, and then only if mortgage loans are normalized and state support and assistance to regional administrations is provided;

- according to Demenyuk the price is per 1 sq.m. will decrease next year;

- for Yekaterinburg, an adjustment of 5-7% from the current cost is possible. More precise figures will depend on the quality, prestige, convenience and general condition of the facilities;

- cost of 1 sq.m. living space is quite high and reaches 45 thousand rubles, if you do not take into account credit charges and insurance. So even if a price reduction occurs, it will not be significant. However, something is still better than nothing.

The reason for this state of affairs is the general situation in the country. To have the most complete idea about it, it is useful to familiarize yourself with the website.

The Ural Chamber of Real Estate gave its forecast for the real estate market in 2016-2017. Its analysts believe that apartments of the old stock, that is, in houses built in the 60-70s of the 20th century, may become cheaper. We are talking about a price reduction of 6-7%. The president of the organization, E. Bogdanov, is of the opinion that in 2017 it will be easier to buy an apartment than it is now. The market is replete with offers, so by haggling you can buy housing at a reduced price.

V. Trapeznikov, who holds the post of executive director, gave his comment. He believes that in 2017-2018. developers will have to make more efforts to attract buyers, since only housing of the highest quality will be purchased. Over the past decade, developers have had less hassle. Sellers received great benefits in the housing market, there were more and more buyers, and apartments were snapped up even before the property was completed.

Next year, as experts believe, at the time of commissioning of houses, only 50% of apartments will find owners. Developers will have to focus on the quality of housing and associated infrastructure, so that the Russian population will be provided with a new generation of new buildings.

I. Dobrokhotova (Best-Novostroy) argues that a positive scenario is unlikely in the current situation. In her forecast for the real estate market in 2017, she says that even an increase in the cost of a barrel of oil to $45 will not save the sector from the crisis; the recession will continue to occur. As long as oil costs $30, developers will have to postpone many projects, and some of them will have to radically change (reduce the square footage of apartments, purchase cheaper building materials). The market has a chance to hold out if developers introduce installment plans on a long-term basis.

Cost of secondary real estate

Russians do not stop investing in real estate, however, secondary housing has been steadily falling in price since the beginning of this year, and demand for it is falling. Experts say that we can already conclude that there will be a future reduction in the scale of construction. This is due to reduced access to mortgage lending. In today's realities, few Russians can purchase an apartment without unnecessary hassle, without using the services of a bank.

Considering the high cost of 1 sq.m., most citizens prefer the secondary market. Prices in this market segment are rising inexorably and people are willing to sacrifice some amenities. For example, in 2015, housing in the central regions of the state rose in price by 15%, and in the Urals, “resale” prices began to cost 10% more. So the 2017 real estate forecasts for Moscow are characterized by downright astronomical prices, especially for new buildings. There is already a noticeable increase of 18% compared to last year.

The cost of “luxury” apartments in cities remote from the center increased by 3%. For increased comfort of apartments you have to pay 11% more.

Primary property

Potential buyers have perked up due to the stagnant real estate market. They believe that construction volumes are gradually falling, as is demand. That is, it will be possible to buy an apartment at a lower price than before. However, Utopia would be the sale of housing by construction companies at a loss to themselves. Companies are already recognizing that they will most likely have to raise prices by about 14-16%.

St. Petersburg analysts and employees of real estate companies claim that the price increase will be about 11-13%. Back in 2015, 40% fewer real estate purchase agreements were concluded than previously. The trend promises to only get stronger in the future. Many projects are frozen because they do not see any feasibility or because they do not have sufficient funds for construction. For example, in Yekaterinburg, 30 thousand square meters remained unfinished. housing.

If the economic situation deteriorates further, even more construction will come to a halt. The main reasons for this are the fall in oil prices, the shaky position of the ruble, and sanctions from the West. All of them are closely intertwined with each other. So only an improvement in the general economic atmosphere can save the situation. If no positive developments occur, demand for real estate will decrease by 30% throughout the Russian Federation, and in certain regions - by 50%.

Forecast for real estate in Ukraine for 2017

The purchasing power of Ukrainians is also falling, and the position of the national currency remains unstable. Developers of the primary market have no choice but to organize all kinds of discounts and promotions to attract buyers.

The situation is better for those companies that build “economy” or small apartments. There is even some growth in demand in this sector. Ukrainians insure their funds by investing in real estate, since they consider this path more reliable than using the services of banks, which have repeatedly failed citizens during the crisis that began in 2009.

When another currency rush occurred, it quite clearly affected the price of real estate. Prices fell in all regions, even in the west. The market in this part of the country was stable back in 2015. However, if you convert dollar prices into hryvnia, the offers of construction companies sharply lose their attractiveness.

V. Nesin (Real Estate Chamber of Ukraine) gave a negative forecast for real estate prices in Ukraine in 2017. He believes that they will grow and reach the level observed before the crisis. If this point of view is correct, Ukrainians need to buy apartments in the last months of 2016, while prices are still relatively attractive.

In the outskirts of Kyiv you can now buy an apartment with 1 room for 25 thousand dollars. The expert says that next year this price will remain only a pleasant memory. This can be explained by several factors: the welfare of Ukrainian residents is expected to improve and demand from foreign investors is expected to increase. Analysts insist on the future progress of the market, however, with slow dynamics.

Leading real estate market analysts believe that the market has already found the bottom and its recovery will begin next year

Interviewed by Pavel Yaklashkin

Most likely, in 2017, demand will remain at the level of 2016, perhaps we will notice an increase of 10-15%, subject to a favorable economic and political situation in the country.

Director of the consulting and project management department at Metrium Group Anna Sokolova:

I believe that 2017 will be similar to the outgoing year in terms of price dynamics: the increase in the cost of new buildings will be restrained by intense competition in the market due to the large volume of supply. However, unlike the current year, it will be characterized by more positive trends in the economy, as many analysts expect an increase in GDP. I do not rule out that this will encourage wealthy clients, who are currently taking a wait-and-see approach, to make purchases.

In addition, further reductions in mortgage rates are possible. In particular, Sberbank has already announced a promotion with rates reduced by 0.5%, which will be valid in January. Thus, the minimum rate on a mortgage loan from Sberbank next year will drop even below the subsidized rate (11.5%). I believe that other systemically important banks will follow Sberbank’s example. Competition between lenders is growing in the mortgage market, which, even without government support, will push them to reduce the cost of their loan offers.

Analysis of the commercial real estate market in Moscow at the end of the first half of 2017

This market analysis was prepared based on information published in the public domain on the websites: https://www.cian.ru/, http://realty.dmir.ru/, https://rosreestr.ru/, etc.

According to Rosreestr (https://rosreestr.ru/), in the first half of 2017, about 600 purchase and sale agreements for commercial real estate were registered in Moscow. The most expensive transaction was registered in March 2017: non-residential premises with a total area of 13,404.6 m² were sold in the Danilovsky district of the Southern Administrative District of Moscow, the transaction amount was 1,700,000,000 rubles / 126,822.14 rubles per square meter. The minimum amount of the registered transaction was recorded in February 2017 and amounted to 275,000 rubles / 8,487.65 rubles per square meter: a non-residential building with a total area of 32.4 m² was sold in the Veshnyaki district of the Eastern Administrative District of Moscow.

An analysis of the commercial real estate market in Moscow shows that there is no shortage of supply of commercial properties in the capital: the entire range of commercial real estate of various classes and purposes is presented on the market. At the end of the first half of 2017, more than 50,000 office, retail, industrial and warehouse real estate properties were offered for sale in the city.

Most of all office properties are offered for sale - 72%, in second place is retail real estate - 21%, followed by industrial and warehouse real estate - 7%.

In terms of the number of proposals, the Central Administrative District (CAO) is in the lead, followed by the Southern and Northern Administrative Districts (Southern Administrative District and Northern Administrative District), in third place are the Western, Southwestern and Northeastern Administrative Districts (ZADO, SWAD and NEAD), followed by the Eastern Administrative Okrug and the South-Eastern Administrative District (VAO and SEAD), the North-Western Administrative District (SZAO), the Novomoskovsk Administrative District (NAO), the last place was shared by the Zelenograd and Troitsky Administrative Districts (ZelAO and TAO).

The distribution of the total supply for the sale of commercial real estate in the city of Moscow by type of real estate, at the end of the first half of 2017, is as follows:

Figure 1. Distribution of the total supply for the sale of commercial real estate in Moscow by type of real estate

Most of all office properties are offered for sale - 49%, in second place is retail real estate - 48%, followed by industrial and warehouse real estate - 3%.

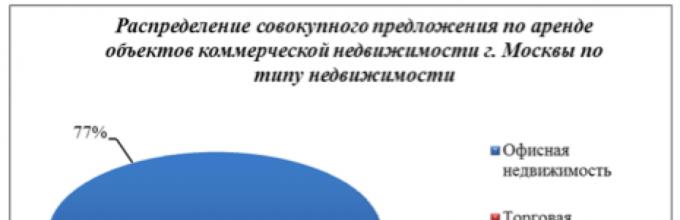

The distribution of the total supply for rental of commercial real estate in the city of Moscow by type of real estate, at the end of the first half of 2017, is as follows:

.png)

Figure 2. Distribution of the total supply for rental of commercial real estate in Moscow by type of real estate

The vast majority of commercial properties offered for rent are office real estate - 77%, followed by retail real estate - 15%, followed by industrial and warehouse real estate - 8%.

In terms of the number of proposals, the Central Administrative District (CAO) is in the lead, the Southern Administrative District (SAD) is in second place, the Northern and North-Eastern Administrative Districts (NAD and NEAD) are in third place, followed by the South-Eastern, Western, Eastern and South-Eastern Administrative Districts. Western Administrative Okrug (YuVAO, ZAO, VAO and SWAO), North-Western Administrative Okrug (NWAO), Novomoskovsk Administrative Okrug (NAO), the last place was shared by Zelenograd and Troitsky Administrative Okrug (ZelAO and TAO).

To improve the quality of the analytical base and the quality of the analysis of the commercial real estate market, the city of Moscow was divided into 24 zones. The division was based on large transport arteries of the city, such as: the Garden Ring, the Third Transport Ring, Mira Avenue, Kutuzovsky Prospekt, Pavlovskaya Street, Nikoloyamskaya Street, the Moscow Ring Road and the Moscow Small Ring (Route A107, “first concrete road”).

The highest average cost of 1 m² of office real estate within the boundaries of “old Moscow” was recorded in the Central Administrative District (within the UK) - 394,784 rubles, the lowest in the ZelAdministrative District - 91,326 rubles. The highest average rate for 1 m² of office real estate offered for rent was recorded in the area from Mira Avenue to Kutuzovsky Avenue (from SK to TTK) and amounted to 24,191 rubles per year, the lowest in the North-Eastern Administrative District (beyond the Moscow Ring Road) - 10,460 rubles per year .

The highest average cost of 1 m² of retail real estate within the boundaries of “old Moscow” was recorded in the Central Administrative District (within the UK) - 655,000 rubles, the lowest in the Northern Administrative District (outside the Moscow Ring Road) - 91,095 rubles. The highest average rate for 1 m² of retail real estate offered for rent was recorded in the area from Nikoloyamskaya Street to Mira Avenue (from SK to TTK) and amounted to 57,239 rubles per year, the lowest in the North-Eastern Administrative District (beyond the Moscow Ring Road) - 15,600 rubles per year .

The highest average cost of 1 m² of industrial and warehouse real estate within the boundaries of “old Moscow” was recorded in the South-Western Administrative District (from the Third Transport Ring Road to the Moscow Ring Road) - 145,051 rubles, the lowest in the Eastern Administrative District (beyond the Moscow Ring Road) - 28,036 rubles. The highest average rate for 1 m² of industrial and warehouse real estate offered for rent was recorded in the Central Administrative District (within the UK) and amounted to 14,223 rubles per year, the lowest in the Northern Administrative District (outside the Moscow Ring Road) - 4,140 rubles per year.

The average cost of 1 m² of commercial real estate in Moscow for all zones, at the end of the first half of 2017, is presented in the table below:

.png)

Table 1. Average cost of 1 m² of commercial real estate in Moscow at the end of the first half of 2017

The minimum (min) and maximum (max) costs of 1 m² of commercial real estate in the city of Moscow in all zones, at the end of the first half of 2017, are presented in the table below:

.png)

Table 2. Minimum (min) and maximum (max) cost of 1 m² of commercial real estate in Moscow at the end of the first half of 2017

* SK - Garden Ring; TTK - Third Transport Ring; MKAD - Moscow Ring Road; MMK (A107) - Moscow Small Ring (road A107).

The average cost of 1 m² of commercial real estate in Moscow by property class (classes A and B), at the end of the first half of 2017, is presented in the table below:

Table 3. Average cost of 1 m² of commercial real estate in Moscow by property class at the end of the first half of 2017

* SK - Garden Ring; TTK - Third Transport Ring; MKAD - Moscow Ring Road; MMK (A107) - Moscow Small Ring (road A107).

The minimum cost of 1 m² within the boundaries of “old Moscow” in the office real estate segment was recorded in the South-Eastern Administrative District (from the Third Transport Ring Road to the Moscow Ring Road) and amounted to 36,344 rubles, the maximum cost was recorded in the Central Administrative District (within the UK) and amounted to 2,105,263 rubles. The minimum rate for 1 m² of office real estate offered for rent was fixed in two zones at once: in the area from Pavlovskaya Street to Nikoloyamskaya Street (from SK to TTK) and in the South-Eastern Administrative District (from TTK to MKAD), and amounted to 1,000 rubles per year . The maximum rental rate for 1 m² was recorded in the area from Nikoloyamskaya Street to Mira Avenue (from SK to TTK) and amounted to 144,000 rubles per year.

The minimum cost of 1 m² within the boundaries of “old Moscow” in the retail real estate segment was recorded in the Eastern Administrative District (beyond the Moscow Ring Road) and amounted to 33,058 rubles, the maximum cost was recorded on the section from Nikoloyamskaya Street to Mira Avenue (from SK to the Third Transport Ring) and amounted to 3,206 349 rubles. The minimum rate for 1 m² of retail real estate offered for rent was fixed in the South-Eastern Administrative District (outside the Moscow Ring Road) and amounted to 1,164 rubles per year. The maximum rental rate for 1 m² was recorded in the area from Pavlovskaya Street to Nikoloyamskaya Street (from SK to TTK) and amounted to 405,000 rubles per year.

The minimum cost of 1 m² within the boundaries of “old Moscow” in the industrial and warehouse real estate segment was recorded in the South-Eastern Administrative District (from the Third Transport Ring Road to the Moscow Ring Road) and amounted to 8,165 rubles, the maximum cost was recorded in the Closed Joint-Stock Company (from the Third Transport Ring Road to the Moscow Ring Road) and amounted to 145,985 rubles. The minimum and maximum rates for 1 m² of industrial and warehouse real estate offered for rent were fixed in the South-Eastern Administrative District (beyond the Moscow Ring Road) and amounted to 970 and 42,840 rubles per year, respectively.

Moscow is a major cultural center of Europe and the world; more than a third of the country's historical sites are concentrated in the city, many of which are included in the UNESCO World Heritage List. The thousand-year history of Moscow is also preserved in its architecture - the city is home to cultural heritage sites with federal, regional and designated protected status, many of which are offered for sale as commercial real estate.

The distribution of the total supply for the sale/rent of cultural heritage objects for commercial purposes in the city of Moscow by protection status, at the end of the first half of 2017, is as follows:

Figure 3. Distribution of the total supply for the sale/rent of cultural heritage objects for commercial purposes in Moscow by protection status

Most of all, identified objects of cultural heritage are offered for sale - 45%, in second place are regional objects of cultural heritage - 38%, followed by federal objects of cultural heritage - 17%.

The majority of commercial properties offered for rent are regional cultural heritage sites - 45%, identified cultural heritage sites are in second place - 40%, followed by federal cultural heritage sites - 15%.

Most of the cultural heritage objects proposed for sale are located within the Third Transport Ring, therefore, in order to improve the quality of the analytical base and the quality of the analysis of the market for cultural heritage objects for commercial purposes, the city of Moscow was divided into 2 zones: the Central Administrative District (within the SK) and the area between the SK and the Third Transport Ring . Outside the Third Transport Ring, no proposals for the sale of cultural heritage objects for commercial purposes have been found.

The average, minimum (min) and maximum (max) costs of 1 m² of cultural heritage objects for commercial purposes in the city of Moscow, at the end of the first half of 2017, are presented in the table below:

Table 4. Average, minimum (min) and maximum (max) costs of 1 m² of cultural heritage objects for commercial purposes in Moscow at the end of the first half of 2017

The average cost of 1 m² of cultural heritage objects for commercial purposes in the city of Moscow by protection status, at the end of the first half of 2017, is presented in the table below:

Table 5. Average cost of 1 m² of cultural heritage objects for commercial purposes in the city of Moscow by protection status at the end of the first half of 2017

* SK - Garden Ring; TTK - Third Transport Ring.

The highest average cost of 1 m² of cultural heritage objects for commercial purposes was recorded in the Central Administrative District (within the UK) - 458,060 rubles for a federal cultural heritage object, the lowest in the area between the UK and the Third Transport Ring - 248,472 rubles for a regional cultural heritage object. The highest average rate for 1 m² of cultural heritage objects for commercial purposes offered for rent was recorded in the Central Administrative District (within the UK) and amounted to 30,927 rubles per year for a federal cultural heritage object, the lowest in the area between the UK and the Third Transport Ring - 16,200 rubles per year for a federal cultural heritage site.