Money is the most liquid part of operating assets and represents money on hand, as well as in settlement, current, currency, deposit and special accounts. The main source of data on their movements is Form No. 4 of the accounting report Cash Flow Report in 1C, which provides the ability to maintain analytical accounting in the context of DDS items. Cash flow items in 1C are additional analytics (subconto) for some accounting accounts, for example, accounts 50/Cash and 51/Settlement accounts.

Another source of information about the movement of money is the management report “Cash Flow Analysis”. To generate a cash flow tax form or such a report, you need to set up cash flow items in 1C 8 (set up DDS items in the “DDS Items” directory). Its correct maintenance and timely completion of the required DDS articles in the relevant documents in the “Bank and Cash Office” section is the key to the correctness of the report.

So, let's look at the tools for maintaining records in the context of DDS in the 1C Enterprise Accounting 8.3 program.

Setting up a chart of accounts

To work with the article directory, you must first complete the settings, which are located in the section “Administration/Accounting parameters/Setting up the chart of accounts/DDS accounting: By account and DDS items” or in section “Main/Chart of accounts/Setting up the chart of accounts.”

Figure 1 Setting up DDS accounting by item

Directory “Cash flow items”

This directory is located “Directories/Bank and cash desk/DDS Articles”.

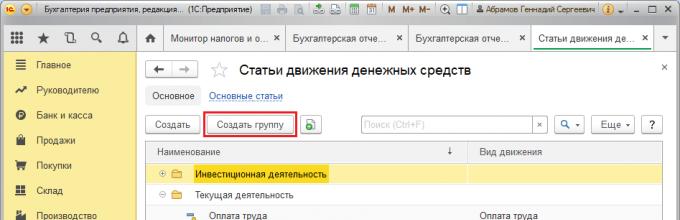

Since the financial flows of a company are classified into three types of work - everyday work related to investment, as well as finance, DDS articles in the directory can be combined into appropriate groups. To do this, use the “Create Group” button.

Figure 2 Directory of articles

Figure 2 Directory of articles

Let us give examples of types of DDS classified by type of activity.

Table “Examples of types of DDS”

Let's consider filling out the details of the article directory element.

The values of the attribute “Use by default in operations” correspond to the values of the attribute “Type of operation” in the documents of the 1C Accounting 8.3 program and serve to automatically substitute the DDS item into the corresponding line of the document for the receipt or expense of DS

Figure 3 “Use by default in operations” attribute of the article directory element

Figure 3 “Use by default in operations” attribute of the article directory element

Figure 4 Details “Type of transaction” and “DDS item” in the document “Write-off from current account”

Figure 4 Details “Type of transaction” and “DDS item” in the document “Write-off from current account”

The values of the “Type of movement” attribute correspond to the lines of form No. 4 “DDS Report”. Types of cash flows are predefined, that is, types of DDS in 1C 8.3 are not intended for editing.

Figure 5 “Type of movement” attribute of the DDS article directory element

Figure 5 “Type of movement” attribute of the DDS article directory element

DDS articles created in the directory are used to fill in the “DDS Article” requisite in program documents. For example, in bank documents “Receipt to account” and “Write-off from account” or cash register - cash receipt and expenditure orders.

Form No. 4 “Cash Flow Statement”

Accounting statements for the year using the fourth form can be generated in the section “Manager/Monitor of taxes and reporting/Accounting statements”.

Figure 6 ODDS form

Figure 6 ODDS form

When creating a report form, the monetary amounts registered by item will be attributed to one or another type of movement of assets, depending on the items specified when posting the relevant documents.

Let's demonstrate the above with an example. Let’s assume that through “Receipts to account” under the movement item “Receipts from the sale of products and goods, performance of work, provision of services” a payment from the buyer was recorded in the amount of 102,135.00 rubles, including VAT of 15,579.92 rubles.

Figure 7 Details “DDS Article” of the document “Receipt on account”

Figure 7 Details “DDS Article” of the document “Receipt on account”

In the setting of the article we are considering, the type of movement of the same name is indicated.

Figure 8 Setting up the item sales receipts

Figure 8 Setting up the item sales receipts

Thus, the registered payment from the buyer under the DDS article with the type of movement “Receipts from the sale of products and goods, performance of work, provision of services” on form No. 4 of the report will be included in the total amount on line 4111 “Receipts from the sale...”.

Figure 9 Payment from the buyer in ODDS

Figure 9 Payment from the buyer in ODDS

Decoding line 4111 allows you to see the components of the total amount for this line. In our example, the final amount of 87 thousand rubles was obtained as the difference between the amount of payment from the buyer of 102,135.00 rubles and VAT of 15,579.92 rubles (86,555.08 ~ 87 thousand rubles).

Figure 10 Explanation for line 4111 “Proceeds from the sale...”

Figure 10 Explanation for line 4111 “Proceeds from the sale...”

Cash flow analysis report

This management analytics is available to “Manager/Cash”.

In order for the information in the report to be grouped by DDS items, you should select the “Cash flow item” checkbox in the report settings on the “Grouping” tab. The report settings are hidden under the “Show settings” function button.

Figure 11 Report “Analysis of cash flows”

Figure 11 Report “Analysis of cash flows”

Figure 12 Report settings

Figure 12 Report settings

Assessment of the state of the DDS

ODDS represents the information basis for analytical conclusions of cash flows. Based on their condition, we can draw a conclusion about the level of enterprise management.

Figure 13 Analysis of the quality of enterprise management depending on the structure of cash flows

Figure 13 Analysis of the quality of enterprise management depending on the structure of cash flows

When the mass of net cash flow from current operations for the reporting period is positive, and from investment and financial transactions, respectively, negative, then the state of the company is considered good. When the cash flow as a result of current and financial operations for the reporting period goes into positive territory, and as a result of investment operations - into negative, the enterprise is said to be in a normal state of affairs.

An enterprise is in crisis if the value of net cash flow from current operations is negative, and from investment and financial operations is positive. The most correct situation is when the value of net cash flow for all types of business processes has a positive value.

The report is intended to analyze cash flows over a certain period of time.

Data can be grouped by form of payment (cash, non-cash), by current accounts (cash desks), and cash flow items.

This report differs from the standard report of the 1C subsystem in that it is supplemented with data on initial balances, turnover for the period and ending cash balances. You can also customize the report by article and by business unit. Report results can be grouped by time periods (days, decades, months, etc.).

For the convenience of users, the following report options are configured on the control panel:

To generate a report you must:

- Set period

- Select a report option by clicking on it (the selected tab will change color)

- If necessary, adjust the selection

- Click the “Generate” button.

Setting up the report « Bank statement» will generate a report on DDS on the company’s current account for a specified period.

To build a report, the program uses data from accumulation registers Cash flows And Cash that move documents:

- Incoming payment orders

- Outgoing payment orders

- Payment orders: cash receipts

- Payment orders: debiting funds

- Payment Requests: Received

- Payment requirements: issued

- Cash checks

Setting up the report « Cash book» will generate a DDS report for the cash register(s) of the enterprise.

To generate a report, the program uses an accumulation register, which accumulates document data:

- Receipt cash orders

- Expense cash orders

- Internal cash movements

Setting up the report « By counterparties» will generate a report on customers from whom payment was received for a specified period, both cash and non-cash.

Setting up the report « By employees» will show the grouping of funds by employees in the context of movement items, show the total amounts of receipts and expenditures of money for each item, and a breakdown of each item by employee.

Setting up the report « By articles and divisions» will show the grouping of funds in the form of a cross-table, in the rows of which - cash flow items, and in the columns - divisions (centers of financial responsibility) of the enterprise.

The report provides selections for all dimensions of the Cash Flow register.

In the “Selection by counterparty” field, click the “Select” button (F4), click the “Selection” button, and select the desired option from the drop-down list:

Cash desk from the directory "Cash desk"

Counterparty from the “Counterparties” directory

An organization from the “Organizations” directory

An individual from the directory “Individuals”

Keeping records by cash flow items is necessary in 1C 8.3 Accounting for the correct formation of the cash flow statement (cash flow report).

This report is used by managers and shareholders to analyze the company's performance. This is also one of the forms of annual financial statements (OKUD 0710004) and is submitted no later than three months after the end of the year.

In order to configure the use of cash flow items in 1C 8.3, go to the “Administration” menu and select the “ ” item.

In the form that opens, click on the “Set up chart of accounts” link. Next, select “By current accounts”. In this example, the item is called “By current accounts and cash flow items” due to the fact that all settings were previously set by default.

A 1C setup form for DSS accounting will open in front of you. If the “By cash flow items” flag is not selected by default, select it. Depending on the settings, this flag may be set by default and changing this add-on will not be available.

Click on the “Record and close” button and you can proceed to setting up the DDS articles themselves.

Input and example of filling out a list of DDS articles

The list of DDS articles itself is located in the “Directories” menu.

In the standard delivery of the 1C configuration in the reference book, for example, there is already a certain list of DDS articles. If it is necessary to add new articles, the most important thing is to correctly indicate the type of movement of the DS. The fact is that it directly affects the report on the movement of the DS.

The name can be specified arbitrarily. This directory also supports grouping of its elements. This is not necessary, but it is advisable for further ease of use. In addition, grouping cost items allows you to obtain results for different types of activities in the future.

If you need a specific item to be entered by default when creating any cash receipt or expenditure document, indicate the default operation in its card.

You cannot set multiple default cost items for the same operation. To avoid this, when selecting, those operations that already have a main item assigned will not be displayed.

In the list form, a list of cost items with types of operations is displayed when you click on the “Main Items” hyperlink.

Using the DDS Articles Directory

When generating a DDS report in 1C 8.3, always check the amounts received with the balance sheet for accounts 50 and 51. If the amount in circulation is greater, it means that you did not enter the DDS article in some document. Otherwise, you could indicate a DDS article where this is not required.

Amounts from documents in which the item is not indicated will be displayed in the balance sheet with an empty grouping, so it is not difficult to find them.

If you group them in the DDS articles directory, then in reports you can get results for them by changing the grouping type of the article.

In some other 1C configurations, for example in ERP, DDS items are required for management accounting analytics.

For example, for a certain item, an expense limit is set for a specific month. Then an application is created to spend DS under this item. They are also used in the payment calendar.

Proper accounting for cash flow items not only allows you to submit financial statements on time and without errors, but also helps management analyze the activities of the enterprise in a more structured manner.

1C: Accounting 8.2. A clear tutorial for beginners Gladky Alexey Anatolyevich

Filling out a directory of cash flow items

The 1C Accounting 8 program implements the ability to automatically fill out reporting form No. 4 “Cash Flow Report”. But to use this mechanism, it is necessary to keep records in cash accounts in the context of cash flow items. Let us remind you that the cash accounts are:

Account 50 “Cash” (this account keeps records of the enterprise’s cash);

Account 51 “Current account” (it records the enterprise’s non-cash funds in the current account);

Account 52 “Currency account” (this account is intended for accounting for the enterprise’s funds in foreign currency);

Account 55 “Special accounts in banks” (here the non-cash funds of the enterprise located in special accounts in banks are taken into account - deposits, loans, etc.).

Please note that keeping records of funds by items of their movement is only possible if the appropriate setting is enabled. Execute the main menu command Enterprise? Set up accounting parameters, and in the window that opens, go to the Cash tab (Fig. 3.19).

Rice. 3.19. Setting up cash accounting

On this tab, you need to check the By cash flow items checkbox. In this case, in the interfaces for editing payment documents there will be a field for selecting the cash flow item to which the amount of the document should be attributed. The selection of a cash flow item is carried out from the directory of cash flow items, the contents of which the user can create and edit independently.

ADVICE

If you plan to keep track of funds by items of their movement, it is recommended to enter in the directory in advance the items that you will use. True, you can fill out and edit the directory later (for example, directly in document editing mode), but it is more convenient to fill it out in advance, so as not to be distracted by adding new items to it later.

To switch to the mode of working with the directory of cash flow items, select the position Cash Flow Items in the directory selection window (see Fig. 1.20). As a result, a directory window will appear on the screen, which is shown in Fig. 3.20.

Rice. 3.20. Directory of cash flow items

The program's capabilities include grouping cash flow items depending on their purpose, focus, or other criteria. For example, you can create separate groups for cash and non-cash money, for own and borrowed funds, etc. Note that grouping cash flow items is not mandatory - you can maintain the directory in one general list. If you want to use the grouping mechanism, it is recommended to first create a list of groups (it will have a hierarchical presentation), and then fill the groups with articles.

NOTE

Subsequently, you can move any cash flow item from one group to another.

To create a group of articles, execute the Actions? command in the list window. New group (this command can also be called by pressing the Ctrl+F9 key combination), or a similar context menu command. You can also use the Add Group button, which is located in the toolbar (the names of the toolbar buttons are displayed as tooltips when you move the mouse pointer over them). When performing any of the above actions, the group entry and editing window will appear on the screen, which is shown in Fig. 3.21.

Rice. 3.21. Entering and editing a group of articles

Note that group editing is also carried out in the same window: to switch to editing mode, you need to select the group in the list with a mouse click and execute the Edit context menu command (or a similar Actions menu command) or press the F2 key.

In the Name field, enter the name of the group. In the Group field, you can select a group of articles that will be the parent of the group being created. If the group being created should not be subordinate to any other group, this field must be left blank.

In the Code field, the numeric code of the group of articles is formed. The value of this field is generated automatically by the program after clicking the OK or Write button. If necessary, you can edit the numeric code from the keyboard by first turning on the editing mode using the Actions? command. Edit code. Please note that it is not recommended to edit the code unless absolutely necessary, as this may lead to data corruption.

Entering and editing a group is completed by clicking the OK or Write button in this window. The Close button is intended to exit this mode without saving the changes made.

To enter a new cash flow item into the directory, place the cursor on the group to which this item should be assigned and execute the Actions? Add (this command can also be called by pressing the Insert key combination), or a similar context menu command. You can also use the Add button, which is located in the toolbar. When performing any of the above actions, a window for entering and editing a cash flow item will appear on the screen, which is shown in Fig. 3.22.

Rice. 3.22. Entering and editing cash flow items

In this window, in the Name field, enter the name of the cash flow item using the keyboard. It will subsequently be displayed under this name in the list and selection interfaces. In the Type of cash flow field, from the drop-down list, the contents of which are predetermined in the Configurator, the regulated reporting indicator corresponding to the defined type of movement is selected (in other words, the value of this field is used when automatically filling out form No. 4).

In the Group field, you can select or change the group of articles to which this article will be assigned. To fill in this field, press the selection button or the F4 key, then in the list of article groups that opens, select the required position with the mouse and press the Select button.

As for the Code field, it is filled in and edited in the same way as in the mode of entering and editing a group of articles.

After clicking the OK or Write button in this window, the cash flow item will be added to the directory.

From the book Investment projects: from modeling to implementation author Volkov Alexey SergeevichCash flow plan The cash flow plan (DDS, cash flow) or forecast of receipts (cash inflows) and payments (cash outflows) is intended for calculating receipts, payments and cash balances. It shows free cash flow

author Litvinyuk Anna Sergeevna42. Direct and indirect methods for analyzing cash flows To analyze cash flows, an indicator of their growth is used, including cash and non-cash turnover: cash in hand; funds in the current account; monetary

From the book Financial Accounting author Kartashova Irina43. The coefficient method as a tool of factor analysis in assessing cash flows The coefficient method in cash flow analysis is used to study the levels and their deviations from the planned and basic values of various relative indicators,

From the book 1C: Accounting 8.2. A clear tutorial for beginners author2.3. Accounting for the movement of foreign currency 2.3.1. What regulatory documents regulate the procedure for conducting transactions on a foreign currency account? Law of the Russian Federation dated December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control” as amended and supplemented,

From the book 1C: Managing a small company 8.2 from scratch. 100 lessons for beginners author Gladky Alexey Anatolievich5.2. Accounting for the presence and movement of fixed assets 5.2.1. What is meant by an inventory object? An inventory object of fixed assets is an object with all fixtures and accessories, or a separate, structurally separate item intended for

From the book Business Planning of Investment Projects author Lumpov Alexey AndreevichFilling out the currency directory In the currency directory, you enter, edit and store data about the currencies used in the program. Note that even if the organization does not maintain multi-currency accounting, the currency directory must contain information at least about

From the book Budgeting and cost control in an organization author Vitkalova Alla PetrovnaFilling out a directory of warehouses (storage locations) of an enterprise. For the storage of inventory belonging to the enterprise (or leased, temporarily used, in custody, etc.) appropriate premises are designated, called

From the book Accounting in Medicine author Firstova Svetlana YurievnaLESSON 58. Cash flow items The program's capabilities provide for accounting for cash flow items of a trading enterprise in the context of their cash flow items, which provides additional analytics and accounting detail. Generate a list of cash flow items

From the book Business Plan 100%. Effective business strategy and tactics by Rhonda AbramsLESSON 91. Cash Flow Budget For the purposes of management accounting, a report called the Cash Flow Budget is of no small importance. It presents the following information in a clear and understandable form: the forecast cash balance for

From the book Economic Analysis author Klimova Natalia Vladimirovna6. Cash flow plan So, we have determined the wage fund, there are production parameters, there is a revenue plan, a current cost plan, taxes have been calculated, a profit and loss forecast (report) has been generated. Now we need to collect all this data into a single

From the book MBA in 10 days. The most important programs from the world's leading business schools author Silbiger Stephen3.1. Cash flow budget Cash of any organization is the most important resource in a market economy. An organization at any given moment may experience a shortage of funds, a lack of funds to ensure an appropriate level of

From the author's bookChapter 3. Accounting for financial assets (cash). The procedure for accounting for cash and cash transactions (1st level) Regulatory framework Organization of cash transactions Payments in cash are carried out through the cash desk and

From the author's bookCash flow forecast For most businesses, cash flow analysis is the most important criterion for assessing your activities. If you can't pay your employees, bills, or yourself, you're unlikely to stay in business long, much less

From the author's bookQuestion 68 Direct and indirect methods for analyzing cash flows An organization’s cash is a collection of money in the cash register, in bank settlement, currency, special accounts, in issued letters of credit and special accounts, check

From the author's bookCash Flow Analysis The term "cash flow" is often mentioned in conjunction with the term "leveraged purchase." This is the basis of financial analysis. Wall Street pros can quickly assess the qualitative aspect

From the author's bookCash Flow Analysis Example Quaker Oats Company plans to purchase a crushing machine for $100,000 for its Kansas City facility. The general craze for plant fibers has sharply increased the demand for oatmeal, and the plant can no longer cope. Having bought a car, the company